Where Will XRP Be in 5 Years?

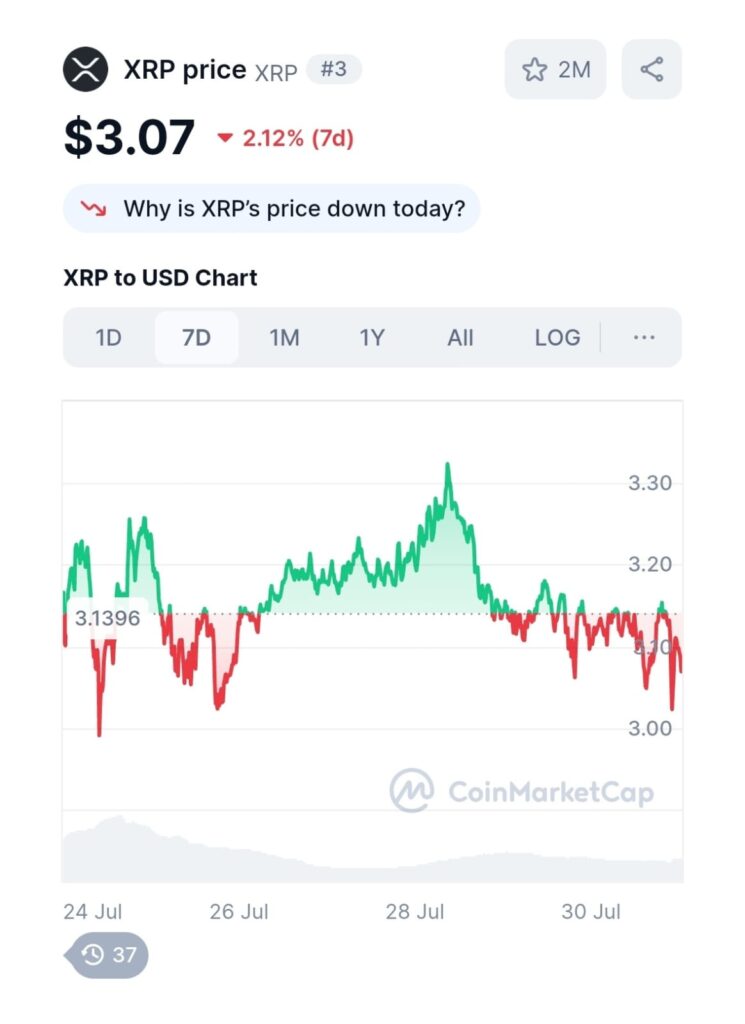

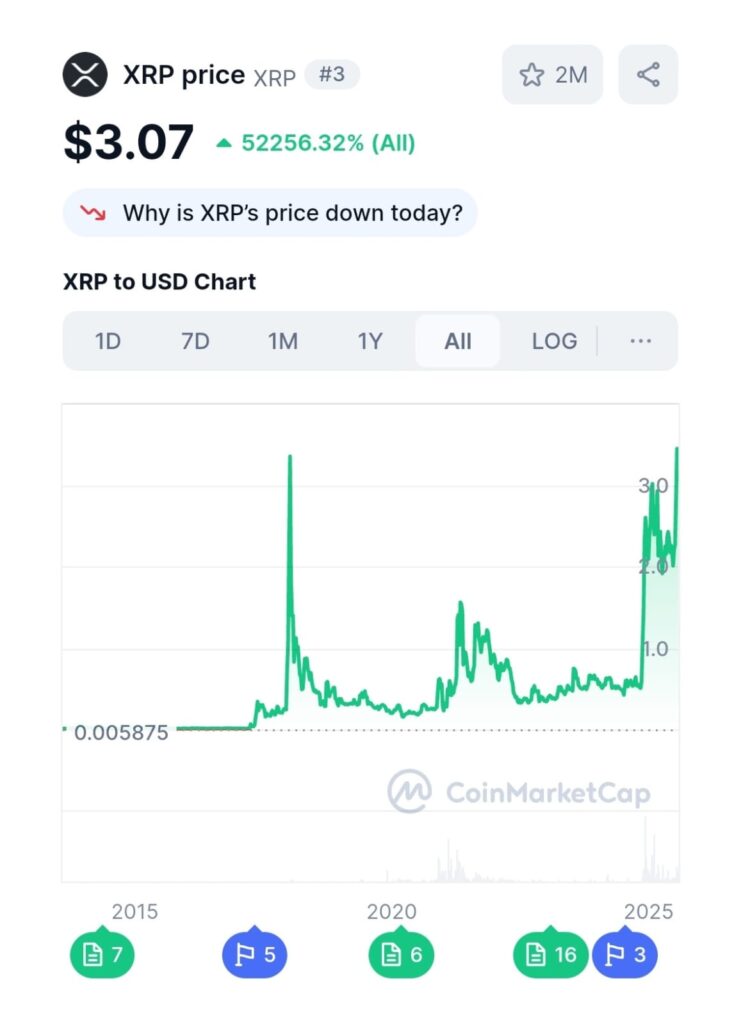

XRP has had a massive year. It’s up nearly 500 percent. That’s not a typo. But as with anything that moves that fast, the real question is what comes next. So, let’s break it down. What’s actually driving this growth? And more importantly, how does this momentum shape the XRP price prediction 5 years from now?

XRP’s Long Game: Replacing SWIFT (Kind Of)

Ripple, the company behind XRP, has been chasing one big goal since the beginning. They want to replace SWIFT, the global network banks use to move trillions of dollars every day. SWIFT’s been around since the 70s, so it’s deeply embedded in the system. But it’s slow, expensive, and not exactly built for the world we live in now.

Ripple says it can do better. Faster transactions. Lower costs. Better security. On paper, it sounds like a no brainer. But here’s the thing convincing big banks to change how they move money isn’t easy. Institutions don’t flip a switch overnight.

So Ripple shifted strategy. Instead of trying to take down SWIFT all at once, they’re picking their battles. They’ve started getting traction in places like India, Brazil, and Singapore. They’re also working with central banks on digital currency projects. These moves won’t immediately drive XRP usage, but they do help Ripple earn credibility in financial circles. And that matters.

Trust Isn’t Built in a Day

Reputation is Ripple’s biggest asset and biggest challenge. The company’s been through its fair share of legal battles. But lately, the regulatory picture’s clearing up. That’s opening doors that were previously shut.

Here’s what Ripple’s doing now. Instead of chasing hype, they’re focusing on the boring but essential stuff: compliance, interoperability, and building tech that actually works for institutions. It’s not flashy. But it’s how you earn trust.

Brad Garlinghouse, Ripple’s CEO, once said XRP could handle up to 14 percent of the volume SWIFT moves daily. SWIFT handles over 5 trillion dollars a day. Even a small piece of that is enormous. With XRP currently sitting at a 200 billion dollar market cap, the upside is clear. The real question is whether they can pull it off.

Progress Will Be Slow But Real

Let’s not pretend this is going to be a straight line. Ripple isn’t going to wake up one day and suddenly dominate the global payments system. That’s not how this works.

What we’re likely to see over the next five years is slow, steady progress. More partnerships. More governments and banks dipping their toes in. And gradually, Ripple could become part of the plumbing behind how money moves across borders.

If that happens, XRP stands to benefit. Big time.

Should You Invest in XRP?

Now for the million dollar question. Is this the time to buy XRP?

- Depends on what kind of investor you are.

If you’re chasing momentum, sure, XRP’s recent rally might catch your eye. But if you’re playing the long game, you need to understand what you’re betting on. This isn’t just a token. You’re betting on Ripple becoming a core part of global finance.

It’s not a sure thing. And not everyone’s convinced. In fact, some top analysts are pointing to other stocks and assets they believe have better odds of outsized returns. That’s fine. XRP isn’t for everyone.

But if you’re okay with some volatility, and you believe Ripple’s strategy will pay off over time, then it’s worth keeping on your radar.

Why XRP Might Be More Than Just Another Crypto Bet

XRP has momentum. But more importantly, Ripple has a plan and they’re sticking to it. No hype, no shortcuts. Just methodical progress.

Over the next five years, don’t expect fireworks. Expect hard earned wins. More adoption. More integration with traditional finance. And if Ripple gets it right, XRP could play a much bigger role in how money moves around the world.

There’s risk. But there’s also potential. The kind that doesn’t come around often.

- So, ask yourself: do you believe in where this is going?

Because if the answer is yes, then XRP might be more than just another crypto bet. It might be a piece of the future.

Curious to learn more?Dive into https://sarazazmi.com/blog/!